In the late 1980s, Nathan Most worked at the New York Stock Exchange. However, he was neither a banker nor a trader, but a physicist with years of experience in the logistics industry, specializing in the transportation of metals and commodities. His focus was not on financial instruments, but on practical systems.

At the time, mutual funds were the mainstream way for investors to gain broad market exposure. While these products offered opportunities for diversification, they also had a trading delay issue: investors could not buy or sell at any time during the trading day; after placing an order, they had to wait until the market closed to know the execution price (it is worth noting that this trading model is still in use today). For investors accustomed to real-time trading of individual stocks, this lagging trading experience was already outdated.

To address this, Nathan Most proposed a solution: develop a product that tracks the S&P 500 index but can be traded like a single stock. Specifically, this involved structuring and packaging the entire index into a new form and listing it on an exchange. This idea was initially met with skepticism, as the design logic of mutual funds differs from stock trading, the relevant legal framework was still underdeveloped, and the market seemed to have no such demand.

Nevertheless, he persisted in pursuing this plan.

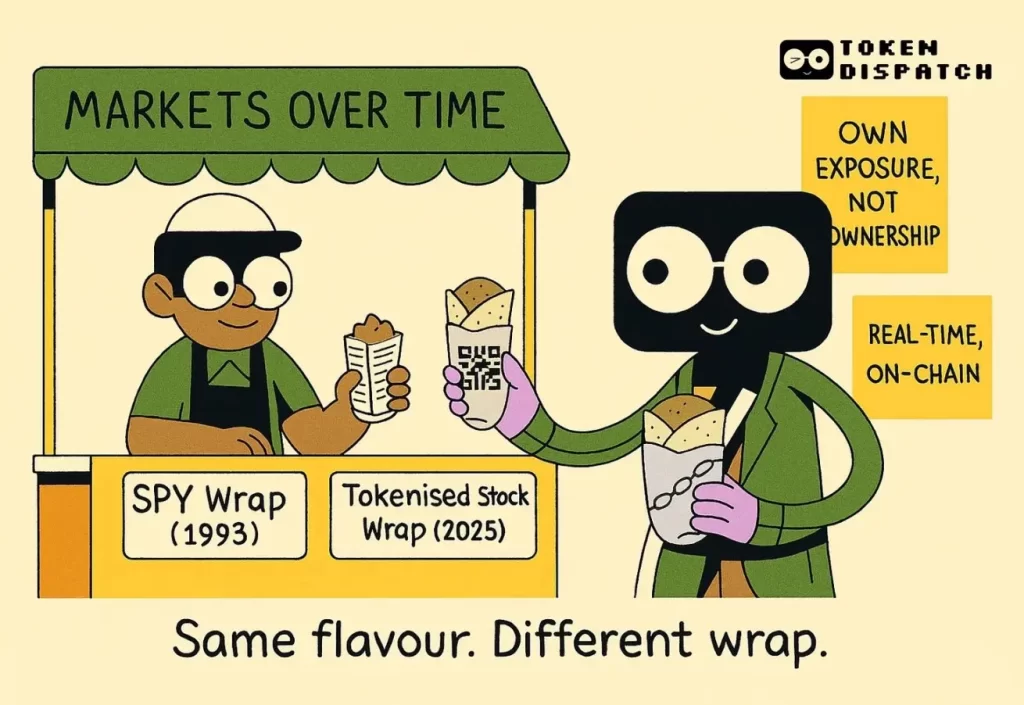

In 1993, the Standard & Poor’s Depositary Receipt (SPDR) debuted under the ticker symbol SPY, effectively becoming the first exchange-traded fund (ETF): an investment vehicle representing hundreds of stocks. Initially viewed as a niche product, it gradually evolved into one of the most actively traded securities globally. On most trading days, SPY’s trading volume even surpasses that of the underlying stocks it tracks. The liquidity of this synthetic product has surpassed that of its underlying assets.

Today, this history holds new relevance. The reason is not the emergence of a new fund, but the transformations unfolding on the blockchain.

Investment platforms such as Robinhood, Backed Finance, Dinari, and Republic are launching tokenized stocks. These blockchain-based assets aim to mirror the stock prices of private companies like Tesla, NVIDIA, and even OpenAI.

These tokens are positioned as “risk exposure tools” rather than ownership certificates. Holders are neither shareholders nor have voting rights. This is not the traditional purchase of equity but rather holding a token linked to the stock price. This distinction is crucial and has sparked controversy, with OpenAI and Elon Musk expressing concerns about the tokenized stocks offered by Robinhood.

Robinhood CEO Tenev later had to clarify that these tokens actually provide retail investors with access to these private assets.

Unlike traditional stocks issued by companies, these tokens are created by third parties. Some platforms claim to provide a 1:1 backing by holding real stocks in custody, while others are entirely synthetic assets. Although the trading experience feels familiar, with price movements aligned with stocks and an interface resembling a brokerage app, the underlying legal and financial substance is often much weaker.

Despite this, they still attract a specific type of investor, particularly non-U.S. investors who cannot directly access U.S. stocks. Suppose you live in Lagos, Manila, or Mumbai and want to invest in NVIDIA. Typically, you would need to open an offshore brokerage account, meet high minimum deposit requirements, and endure lengthy settlement cycles. Tokenized stocks, as tokens traded on-chain and tracking the price movements of underlying exchange-listed stocks, eliminate these trading barriers. No wire transfers, no forms to fill out, no access restrictions—just a wallet and a trading market.

While this investment channel may seem novel, its operational mechanisms share commonalities with traditional financial instruments. However, practical challenges remain: most platforms like Robinhood, Kraken, and Dinari do not operate in emerging markets outside the U.S. stock market. For example, it remains unclear whether Indian users can legally or practically purchase tokenized stocks through these channels. If tokenized stocks aim to genuinely expand global market participation, the challenges they face will not be limited to technical issues but will also include regulatory, geographical, and infrastructure-related hurdles.

The Logic Behind Derivatives

Futures contracts have long provided a way to trade based on expectations without directly holding the underlying asset. Options allow investors to bet on the volatility, timing, or direction of a stock without actually buying it. In either case, these tools have become “alternative channels” for investing in underlying assets.

The emergence of tokenized stocks follows a similar logic. They do not claim to replace traditional stock markets but instead provide an alternative avenue for participation to those who have long been excluded from public investment.

The development of new derivatives often follows a predictable pattern: initially, the market is filled with confusion, investors are uncertain about pricing, traders are hesitant due to risk concerns, and regulators adopt a wait-and-see attitude; then speculators enter the market, testing the product’s boundaries and exploiting market inefficiencies for arbitrage; if the product proves practical, it is gradually adopted by mainstream participants and eventually becomes part of the market infrastructure. Index futures, ETFs, and even Bitcoin derivatives on the CME (Chicago Mercantile Exchange) and Binance all followed this path. They were not originally designed for ordinary investors but rather as playgrounds for speculators: faster trading, higher risks, but also greater flexibility.

Tokenized stocks may follow the same path: first, retail investors use them to speculate on hard-to-obtain assets like OpenAI or unlisted companies; then arbitrageurs discover profit opportunities in price discrepancies between tokens and stocks and join in; if trading volume stabilizes and infrastructure keeps pace, institutional investors may also enter, especially in jurisdictions with robust regulatory frameworks.

The early market may appear chaotic: insufficient liquidity, wide bid-ask spreads, and sudden price jumps on weekends. But derivatives markets always start this way; they are never perfect replicas, but more like stress tests—allowing the market to see if there is actual demand before the asset itself adjusts.

This model has an interesting aspect, which can be seen as either an advantage or a disadvantage, depending on how you look at it—the time lag issue.

Traditional stock markets have opening and closing times, and most stock derivatives follow the stock market’s trading hours. However, tokenized stocks do not adhere to these rules. For example, if a U.S. stock closes at $130 on Friday, and a major news event occurs on Saturday (such as an early earnings leak or a geopolitical event), the stock market is closed, but the token may already be fluctuating. This allows investors to factor the impact of news during market closures into their trades.

Time differences only become an issue when tokenized stock trading volumes significantly exceed those of traditional stocks. Futures markets address such issues through funding rates and margin adjustments, while ETFs rely on designated market makers and arbitrage mechanisms to stabilize prices. However, tokenized stocks have not yet established these mechanisms, so prices may deviate, liquidity may be insufficient, and whether they can keep pace with stock prices depends entirely on the reliability of the issuer.

However, this trust is highly unreliable. For example, when Robinhood launched tokenized stocks for OpenAI and SpaceX in the EU, both companies denied involvement, stating they had no collaboration or formal relationship with the business.

This is not to say that tokenized stocks themselves are problematic, but you must clarify: are you purchasing price exposure, or a synthetic derivative with ambiguous rights and recourse?

For those feeling anxious about this, there’s really nothing to worry about. OpenAI issued this statement simply to be cautious, as they had no choice but to do so. As for Robinhood, they’ve merely launched a token to track OpenAI’s valuation in the private market, just like the tokens for the other 200+ companies on their platform. You’re not actually buying shares in these companies, but shares are merely certificates—the digital form of these assets is what matters. In the future, there will be thousands of decentralized exchanges where you can trade OpenAI, whether it’s private or public. At that point, liquidity will be abundant, bid-ask spreads will narrow significantly, and people worldwide will be able to trade. Robinhood is just taking the first step.

The underlying architecture of these products is also diverse. Some are issued under European regulatory frameworks, while others rely on smart contracts and offshore custodians. A few platforms like Dinari are experimenting with more compliant operational models, while most are still testing the boundaries of the law.

U.S. securities regulators have yet to clarify their stance. While the SEC has stated its position on token issuance and digital assets, tokenized products of traditional stocks remain in a gray area. Platforms are cautious about this, with Robinhood launching its product in the EU first and not daring to launch it in the U.S. yet.

However, the demand is already clear.

The Republic platform provides synthetic investment channels for private companies like SpaceX, while Backed Finance packages public stocks and issues them on the Solana chain. These efforts are still in their early stages but have never ceased. The underlying model aims to address participation barriers rather than the logic of finance itself. Tokenized stocks may not increase holding returns because they never intended to do so; perhaps they simply aim to make participation easier for ordinary people.

For retail investors, the ability to participate is often the most important factor. From this perspective, tokenized stocks are not competing with traditional stocks but rather competing on the “convenience of participation.” If investors can gain exposure to NVIDIA stock price movements by clicking a few times on a stablecoin app, they may not even care whether it is a synthetic product.

This preference has precedents. The SPY exchange-traded fund has proven that packaged products can become mainstream trading markets, and other derivatives like CFDs, futures, and options have done the same. Initially, they were just tools for traders, but eventually they served a broader user base.

These derivatives often even lead the underlying asset’s price movements. In market volatility, they capture sentiment faster than the sluggish traditional markets, amplifying fear or greed.

Tokenized stocks may follow a similar path.

The current infrastructure is still in its early stages, with liquidity fluctuating and regulatory frameworks unclear. However, the underlying logic is clear: create something that reflects asset prices, is easy to obtain, and appeals to ordinary people. If this “alternative” can stabilize, more trading volume will flow into it. Ultimately, it will no longer be a shadow of the underlying asset but will become a barometer of the market.

Nathan Most did not initially set out to reshape the stock market; he simply identified inefficiencies and sought a more streamlined interaction method. Today’s token issuers are doing the same, albeit replacing the “packaging” of funds with smart contracts.

What remains to be seen is whether these new tools can maintain trust during market downturns. After all, they are not real stocks and are not regulated; they are merely “tools that resemble stocks.” However, for many people who are distant from traditional finance or live in remote areas, the ability to “approach” them is sufficient.