Design software developer Figma has officially launched its IPO process and will be listed on the New York Stock Exchange under the ticker symbol “FIG.”

The S-1 filing not only reveals the company’s strong operational growth but also exposes its financial strategy of holding nearly $70 million in Bitcoin ETFs for the first time, with plans to invest an additional $30 million in USDC to increase its holdings, demonstrating its proactive embrace of crypto assets.

Figma announces IPO: Challenging Adobe’s $20 billion valuation

One and a half years after the collapse of Adobe’s $20 billion acquisition deal, Figma announced yesterday that it has initiated its IPO in the United States. According to the latest S-1 filing, Figma has not yet disclosed its expected fundraising amount or valuation range, but the market remains optimistic that the company could surpass Adobe’s record-breaking valuation.

The breakdown of the Adobe acquisition was primarily due to concerns over competition and monopolization raised by regulatory authorities in the US and UK. By choosing to go public independently, Figma has effectively moved beyond the shadow of that failed deal. In the 2024 employee stock repurchase program, the company was valued at approximately $12.5 billion. With the growing momentum of AI and the IPO market, investors are hopeful that the company will surpass this figure upon listing.

Strong revenue performance, aggressive AI expansion

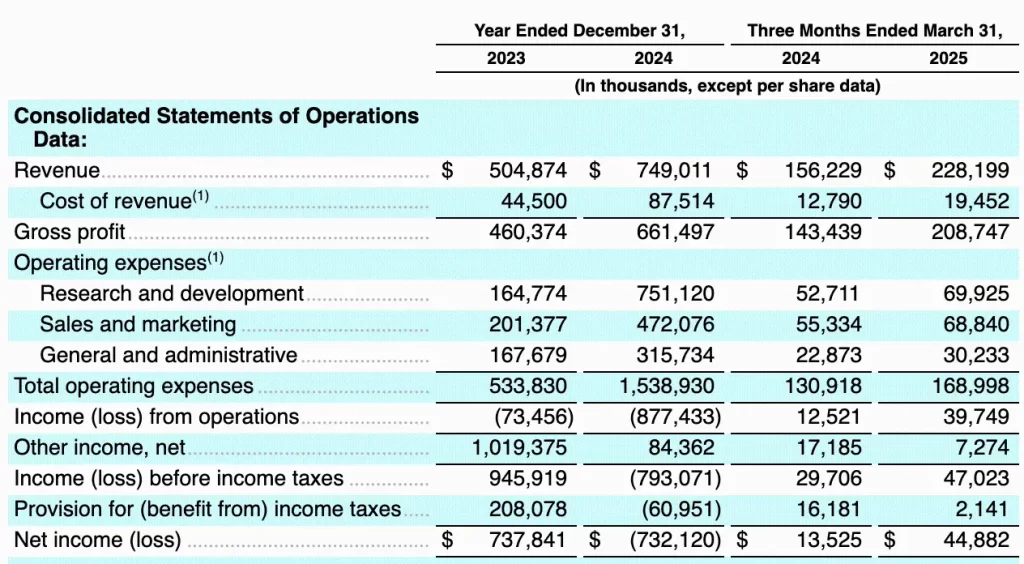

Figma’s financial performance has also drawn attention. Following a loss in 2024, the company reported a net income of $44.88 million in the first quarter of 2025. Revenue for the quarter reached $228 million, representing a year-over-year increase of 46%. For the full year of 2024, revenue totaled $749 million, up 48% year-over-year, reflecting the strong momentum of its subscription-based business model.

Figma CEO Dylan Field emphasized in an investor letter: “AI is at the core of the future design process. We will continue to invest heavily, even though it may temporarily reduce efficiency in the short term. This is an indispensable long-term strategy.” This also aligns with Figma’s ambition, as evidenced by the over 200 instances of AI-related terms in its documents.

Currently, Figma has over 1,000 enterprise customers paying over $100,000 annually and over 11,000 mid-sized customers paying over $10,000 annually. Financial data shows that over half of its revenue comes from markets outside the US, and it will continue to pursue international expansion and mergers and acquisitions in the future.

Figma is also a Bitcoin enthusiast: holding nearly $70 million in Bitcoin spot ETFs

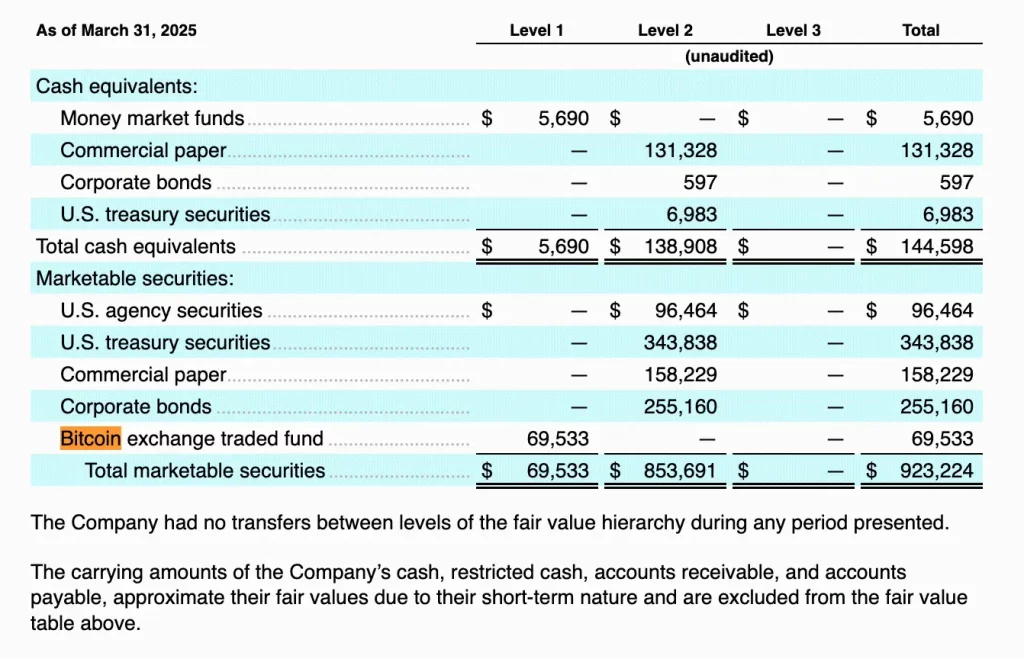

In addition to its strong operational performance, Figma demonstrates a unique strategic vision in its financial strategy. The documents reveal that the company holds approximately $69.53 million worth of Bitcoin through the Bitwise Bitcoin ETF (BITB), with an initial investment of $55 million, currently yielding a profit of about 26%.

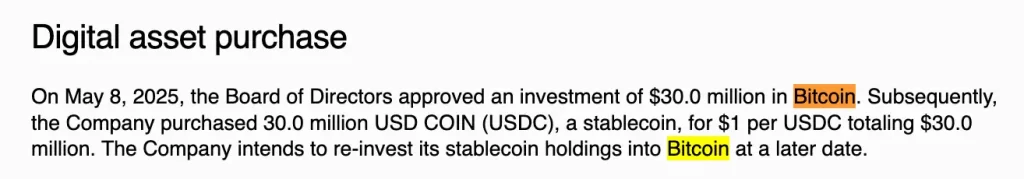

It is worth noting that Figma’s board of directors authorized the purchase of US$30 million in USDC in May this year, which can be flexibly converted into Bitcoin in the future to maintain capital flexibility. This indicates that Figma does not view Bitcoin as a speculative investment, but rather explicitly incorporates it into its long-term cash and capital management strategy.

This investment represents approximately 4% of Figma’s current cash and securities holdings of $1.07 billion, reflecting its strategic alignment with Bitcoin and resonating with companies like MicroStrategy, positioning it as a leading startup that views Bitcoin as a corporate reserve asset.

Founders maintain control over Figma’s direction: planning aggressive mergers and acquisitions for expansion

Dylan Field stated that choosing to go public at this time is not only to enhance brand visibility and secure capital momentum but also to make users and the community an integral part of the company. Through a special voting rights structure, he will retain over 75% of the company’s voting rights, continuing to control the company’s direction, and emphasized that the company will expand through large-scale mergers and acquisitions.

Additionally, the company’s internal venture capital arm, Figma Ventures, has already invested in 18 projects, demonstrating its comprehensive approach from product development to capital allocation. With the prospectus now publicly available, Figma has joined the ranks of leading startups like Circle in going public, sending shockwaves through the 2025 capital markets.