There has been extensive discussion surrounding Bitcoin’s four-year bull and bear cycle. This pattern of exponential growth, sudden collapse, and subsequent rise to new highs has characterized most of Bitcoin’s history. However, it is important to note that there are compelling reasons to believe that this four-year cycle may be coming to an end.

First, we must ask: Why does this four-year cycle exist?

It can be attributed to three key factors:

Halving Effect

Every time the number of blocks increases by 210,000 (approximately every four years), the Bitcoin mining reward is halved. This mechanism creates supply scarcity, typically leading to price increases in the following years.

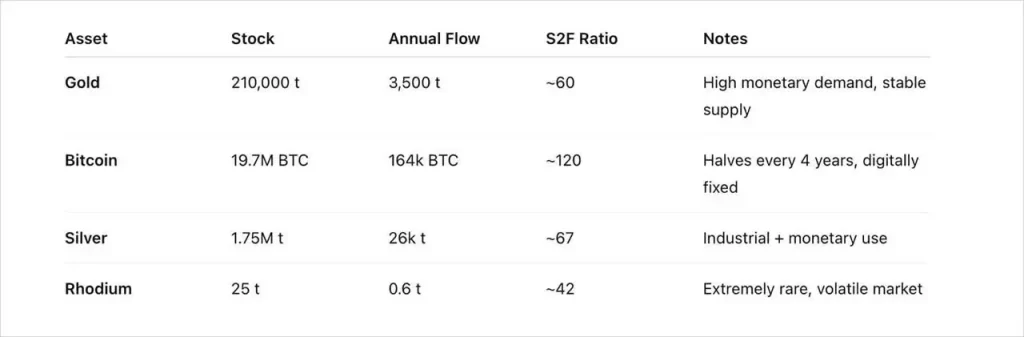

Asset scarcity is often measured by the stock-to-flow ratio (S2F), which is the ratio of the total existing supply to the annual new supply. Taking gold, a scarce asset, as an example, its S2F ratio is 60 (subject to minor fluctuations due to the discovery of new gold mines). The current Bitcoin S2F ratio is approximately 120, meaning its annual new supply is roughly half that of gold. This figure will increase with each subsequent halving.

Global Liquidity Cycle

The correlation between Bitcoin and global M2 liquidity has been explained many times by us and other institutions. It is worth noting that many people believe that liquidity also follows a cyclical pattern of about four years. Although its accuracy is not as high as that of Bitcoin halving, this correlation does exist. If this theory holds true, then the phenomenon of Bitcoin keeping pace with it is logically reasonable.

From a psychological perspective

Every time a bull market surge occurs, it sparks a new wave of widespread adoption. People’s behavioral patterns validate Gandhi’s observation: first they ignore you, then they laugh at you, then they fight you, and finally you win. This cycle repeats itself, with people gradually accepting Bitcoin’s value and granting it greater legitimacy approximately every four years. People inevitably become overly excited, and the subsequent crash resets the cycle.

The question now is: Are these factors still driving Bitcoin’s price?

- Halving Effect

After each halving, the trend of decreasing the proportion of newly minted Bitcoin relative to the total supply has become increasingly weak. When the new supply accounted for 25% of the total supply, the reduction to 12.5% had a significant impact; however, the reduction from approximately 0.8% to 0.4% today has a vastly different level of influence.

- Global Liquidity Cycle

Global liquidity remains a relevant factor for Bitcoin prices, although its influence is evolving. Bitcoin has shifted from being dominated by retail investors to being dominated by institutional investors, altering trading behavior. Institutions are accumulating Bitcoin for the long term, and short-to-medium-term price declines will not drive them out of the market. Therefore, while global liquidity will continue to influence Bitcoin prices, its sensitivity to M2 liquidity will continue to weaken. Additionally, off-exchange institutional purchases of Bitcoin have reduced price volatility, which is the true source of confidence in Bitcoin. Uncontrolled financial expenditures will be absorbed by Bitcoin, propelling it toward a brighter future.

- Psychological Perspective

The broader the adoption of Bitcoin, the stronger its stability in people’s psychological perceptions. The influence of retail selling behavior will weaken, and as market dominance shifts toward institutional buyers, retail-driven price volatility will also decrease.

Overall, Bitcoin remains one of the most promising assets in the world, with its growth model undergoing a transformation from cyclical growth to linear growth (on a logarithmic scale). Global liquidity has become the dominant force in the current market. Unlike most assets, which follow a top-down dissemination path (from institutions to retail investors), Bitcoin has achieved penetration from the grassroots level to mainstream institutions through a bottom-up approach. As a result, we are witnessing the market stabilizing as it matures, with its evolutionary model becoming increasingly standardized and orderly. (Image source: DeathCab)