In July, South Korea’s dormant virtual asset market officially rebounded, experiencing a surge in both volume and price. As of 8 p.m. on July 24, Upbit, the cryptocurrency exchange with the highest market share in South Korea, saw its 24-hour trading volume surpass $10.2 billion, representing a 94.5% increase. Bithumb, the second-largest exchange by market share, also experienced a significant surge, with its 24-hour trading volume exceeding $3.2 billion, marking a 61.5% increase.

Just before this wave of enthusiasm, liquidity had been quietly accumulating at the bottom of the market. According to CryptoQuant data, from July 13 to 19, the trading volume of stablecoins on South Korea’s five major cryptocurrency exchanges—Upbit, Bithumb, Coinone, Cobbit, and Gopax—reached 2.226 trillion won (approximately US$16.2 billion).

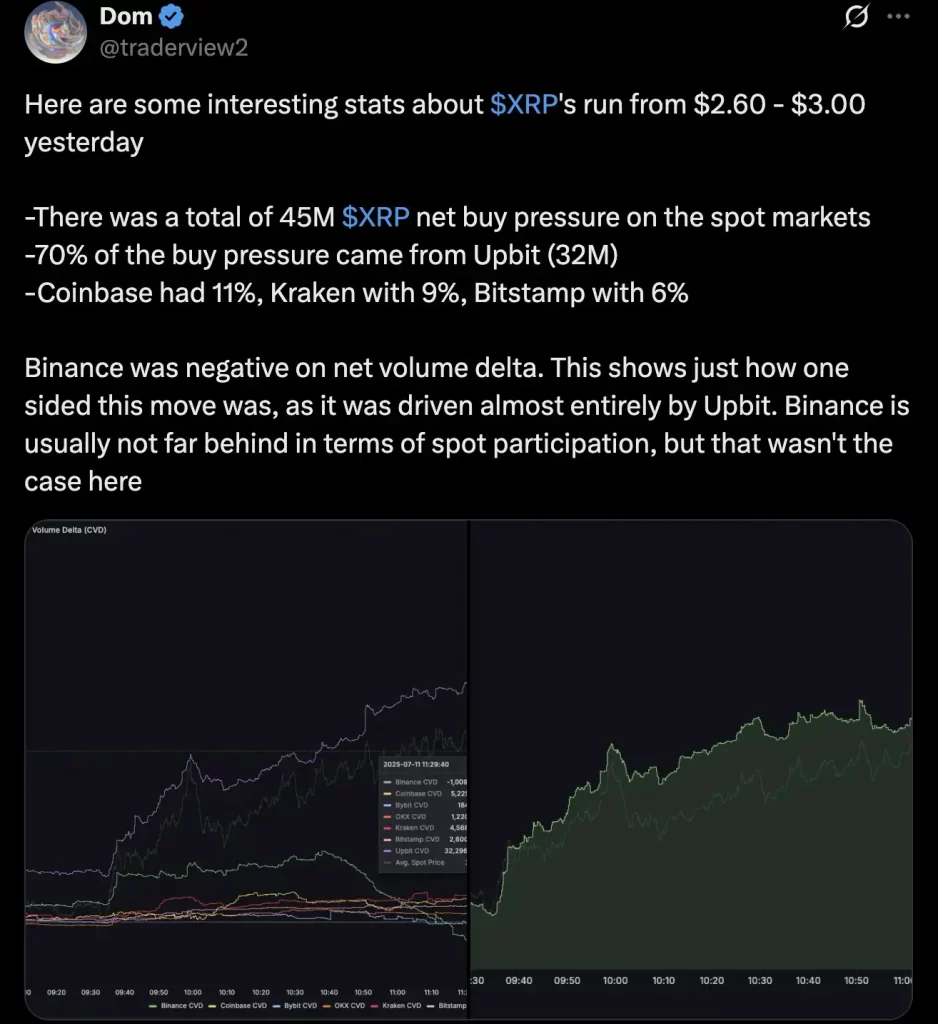

The heightened trading enthusiasm among South Korean investors began to surface on July 11 when they aggressively purchased XRP tokens.

According to data shared by analyst Dom on the social media platform X, the token’s price surged from 2.60 USD to 3.00 USD within a few hours on that day, with a total net buying pressure of 45 million in the spot market, 70% of which came from Upbit (32 million), 11% from Coinbase, 9% from Kraken, and 6% from Bitstamp. This surge was almost entirely driven by South Korean buying activity.

XRP, which ranks third in total market capitalization behind Bitcoin and ETH, is the most popular virtual asset among South Korean investors, accounting for approximately 15% of global trading volume. The token broke through the $3.6 mark on July 18, surpassing its previous all-time high set on January 16 for the first time in six months. As of July 24, the price of XRP was approximately $3.16, with a 24-hour trading volume of $2.28 billion on Upbit, solidifying its position as the platform’s most popular asset.

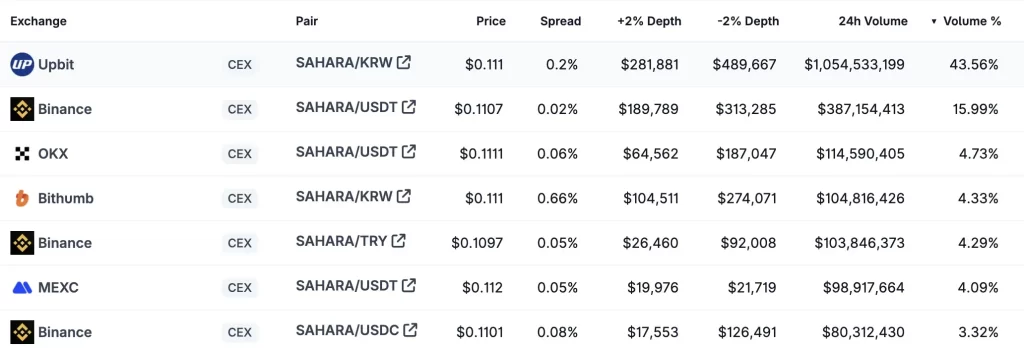

On July 23, the SAHARA token of the “AI-native” full-stack blockchain platform Sahara AI sparked a second wave of excitement. According to PANews, SAHARA saw a single-day peak increase of 86%, ranking third in trading volume on Upbit’s spot market and accounting for 8.76% of the platform’s total trading volume. Today, South Korean investors continued their trading enthusiasm for SAHARA. As of 8 PM on July 24, its 24-hour trading volume reached $2.3 billion, with 43.56% of spot trading coming from Upbit and 4.33% from Bithumb.

After the SAHARA token broke through the $0.16 mark to reach a new all-time high, it experienced a correction. The NEWT token of Newton Protocol, the verifiable automation layer of on-chain finance, began to take center stage.

NEWT has been driven by Korean buying activity to a greater extent than SAHARA. As of 8 PM on July 24, the token had risen over 70% in the past 24 hours, with a 24-hour trading volume of 1.78 billion USD. 57.07% of its spot trading volume came from Upbit, and 4.99% from Bithumb. This clearly demonstrates the concentration and explosive power of Korean retail crypto investors.

In addition to the aforementioned tokens, South Korean crypto investors who favor altcoins have also driven the rise of tokens such as Hyperlane, Babylon, HUMA, LISTA, and MERL.

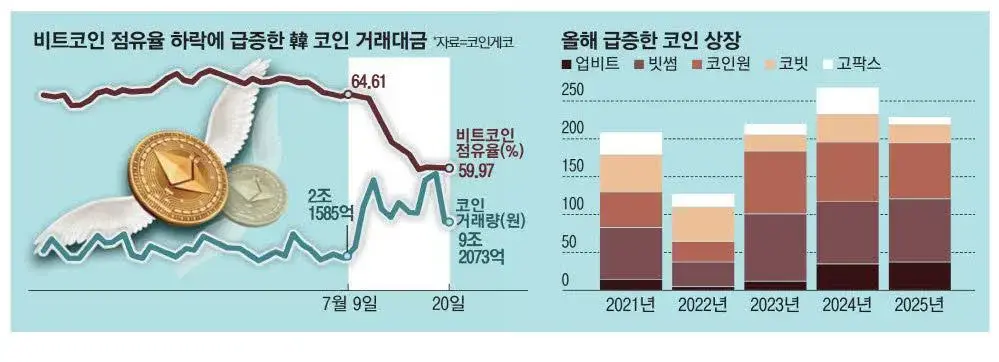

Furthermore, against the backdrop of Bitcoin reaching historical highs, Ethereum making a comeback, and an increasingly favorable regulatory environment, the pace of new listings on South Korean exchanges has also accelerated significantly.

According to a report by South Korean media outlet Maeil Business Newspaper, as of July 21, the five major South Korean virtual asset exchanges—Upbit, Bithumb, Coinone, Cobbit, and GoFox—had listed a total of 229 South Korean won-denominated virtual assets, accounting for 85.44% of the 268 South Korean won-denominated virtual assets listed throughout last year. Upbit and Bithumb have listed 37 and 84 Korean won-denominated virtual assets, respectively, this year, exceeding last year’s listing numbers (35 and 82, respectively). If this trend continues, Upbit and Bithumb are likely to list the highest number of cryptocurrencies in nearly five years this year.

This “listing fever” has not only provided more opportunities for speculative capital but has also led to constant shifts in market trends. The intense capital flows and rapid rotation are accompanied by significant volatility risks: XRP and SAHARA experienced short-term corrections of over 10%, with a surge in margin calls on futures contracts. If liquidity suddenly reverses, prices could face severe fluctuations.

CryptoQuant analysts have also warned that as the altcoin boom finally arrives, the behavior of Korean investors will undergo significant changes. Therefore, amid the surge in new capital inflows, Korean investors’ enthusiasm for altcoins often surpasses that of overseas markets. In small-scale investments, FOMO plays a crucial role in this environment, sometimes posing significant risks to savings.